How to Grow a Life Insurance Business with Twitter

Twitter is not just a platform for sharing thoughts and keeping up with the latest trends. It can also be a powerful tool for businesses, including life insurance companies, to grow their reach and engage with their target audience. In this article, we will explore the various ways in which you can leverage the power of Twitter to strengthen your life insurance business

Understanding the Power of Twitter for Business

Before diving into the specifics, it's essential to understand why Twitter is such a valuable platform for businesses. With over 330 million active users worldwide, Twitter provides a vast potential customer base for your life insurance business. This platform allows you to connect with your target audience in real-time, participate in industry-related conversations, and establish your brand as a trusted authority in the field.

The Basics of Twitter

For those new to Twitter, let's start with the basics. Twitter is a microblogging platform where users can post and interact with short messages called tweets. These tweets are limited to 280 characters, making it crucial to be concise and impactful in your communication. Additionally, Twitter allows users to follow accounts, retweet, reply to, and like tweets to foster engagement and user interaction.

Twitter's user-friendly interface and straightforward navigation make it easy for businesses to get started. With just a few clicks, you can create an account, customize your profile, and start tweeting. The platform also offers various features to enhance your Twitter experience, such as hashtags, which allow you to categorize your tweets and make them more discoverable by users interested in specific topics.

Furthermore, Twitter provides a range of analytics tools that enable you to track the performance of your tweets and gain insights into your audience's preferences and behaviors. This data can help you refine your content strategy and optimize your engagement with followers.

Why Twitter is Important for Your Business

Twitter's importance for your life insurance business cannot be overstated. It offers a unique opportunity to establish meaningful connections with your target audience. By leveraging Twitter's real-time nature, you can keep your followers informed about industry updates, policy changes, and educational resources related to life insurance.

Moreover, Twitter provides a platform for you to address the frequently asked questions of your prospective clients, which can help build trust and credibility. By actively engaging with your audience and providing valuable insights, you position yourself as an expert in the field, making your brand more appealing to potential customers.

Additionally, Twitter offers various advertising options to promote your life insurance business effectively. Through targeted ads, you can reach specific demographics, ensuring that your message reaches the right people at the right time. Twitter's advertising platform allows you to set specific campaign objectives, track conversions, and measure the return on investment (ROI) of your marketing efforts.

Furthermore, Twitter's influential role in shaping public opinion and driving conversations cannot be ignored. By actively participating in industry-related discussions and sharing valuable content, you can establish your brand as a thought leader and influencer in the life insurance sector. This can lead to increased brand visibility, customer loyalty, and ultimately, business growth.

In conclusion, Twitter offers a powerful platform for businesses, including life insurance companies, to connect with their target audience, establish credibility, and drive engagement. By leveraging the features and opportunities provided by Twitter, you can unlock the full potential of this social media platform and take your business to new heights.

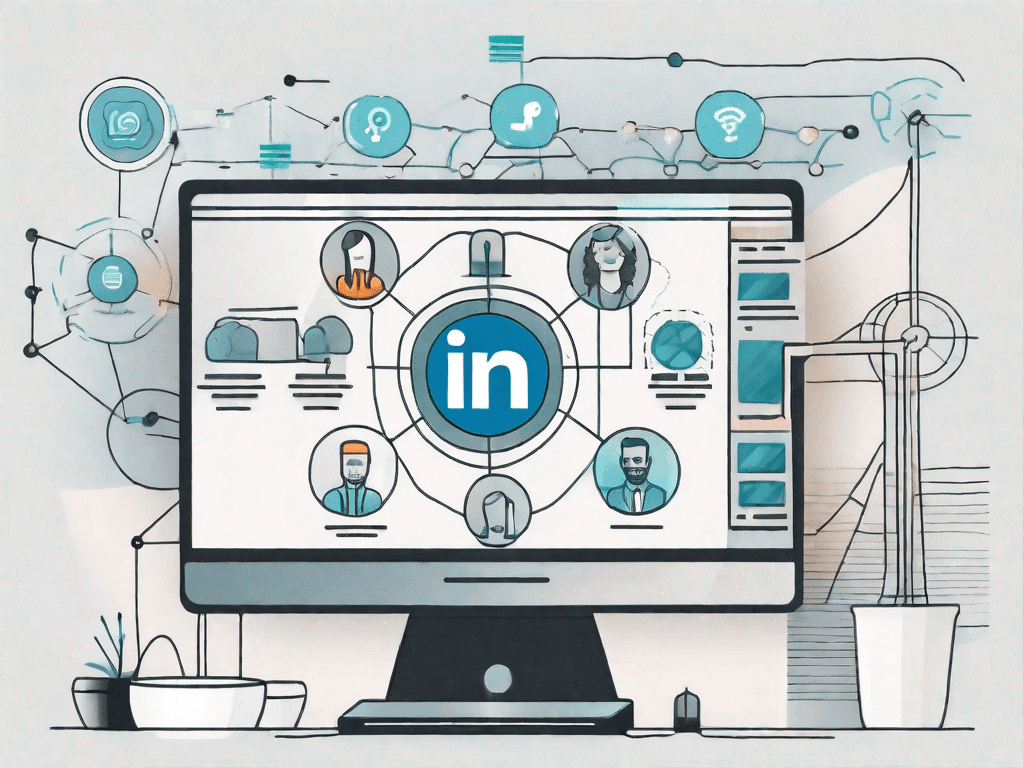

Setting Up a Professional Twitter Profile for Your Life Insurance Business

To make the most of Twitter, it's crucial to set up a professional profile that represents your life insurance business effectively. Your profile is the first impression potential customers may have of your company, so it's essential to make it count.

Creating a strong and professional Twitter profile for your life insurance business can significantly impact your online presence and attract potential clients. By carefully curating your profile picture, header, and bio, you can establish credibility and build trust with your audience.

Choosing the Right Profile Picture and Header

When selecting your profile picture and header, it's important to choose images that align with your brand identity and values. Your profile picture is the visual representation of your business, so consider using your company logo to create brand recognition. This will help potential customers easily identify your business when scrolling through their Twitter feed.

Additionally, your header image should complement your profile picture and convey a sense of professionalism and trust. Consider using high-quality images that reflect the nature of your life insurance business, such as images of families or individuals securing their future.

Remember, consistency is key. Ensure that your profile picture and header are consistent across all your social media platforms to maintain a cohesive brand image.

Crafting an Effective Bio

Your bio is an opportunity to introduce your life insurance business and showcase what sets you apart from the competition. Keep it concise yet compelling, as potential customers will only spend a few seconds reading it. Use this space to highlight your unique selling points and the value you provide to your clients.

Consider including specific details about the types of life insurance policies you offer, such as term life insurance, whole life insurance, or universal life insurance. Mention any specializations or expertise that make your business stand out, such as serving a particular demographic or offering personalized insurance solutions.

Don't forget to include relevant keywords in your bio to improve your discoverability in Twitter searches. Think about the terms potential customers might use when looking for life insurance services and incorporate them naturally into your bio.

Remember, your bio is not just a description of your business; it's an opportunity to connect with your audience on a personal level. Consider adding a touch of personality or a compelling statement that resonates with your target market.

By investing time and effort into creating a professional Twitter profile for your life insurance business, you can establish a strong online presence and attract potential clients. Remember to regularly update your profile with relevant content, engage with your audience, and monitor your analytics to optimize your Twitter strategy.

Developing a Twitter Strategy for Your Life Insurance Business

Now that you have set up your professional Twitter profile, it's time to develop a strategy to effectively engage with your target audience.

Identifying Your Target Audience

To tailor your content and messages, it's essential to identify your target audience. In the case of a life insurance business, your target audience may include individuals in certain age groups, income brackets, or with specific life situations. Knowing your audience will help you create content that resonates with them and addresses their unique needs and concerns.

Setting Your Goals and Objectives

Before diving into posting content, establish clear goals and objectives for your Twitter presence. What do you hope to achieve? Whether it's increasing brand awareness, generating leads, or providing customer support, defining your goals will guide your Twitter strategy and ensure that your efforts are aligned.

Creating Engaging Content for Your Twitter Audience

It's time to start creating content that will captivate your Twitter audience and keep them coming back for more.

Sharing Useful Information About Life Insurance

One way to engage your followers is by sharing useful information about life insurance. Educate them about different policy options, explain industry terms, and provide tips for choosing the right life insurance plan. By offering valuable insights, you position yourself as an expert and build trust among your audience.

Using Twitter to Answer Common Life Insurance Questions

Another effective way to engage with your audience is by using Twitter to answer common life insurance questions. Monitor industry-related hashtags and participate in conversations where people are seeking advice. By providing helpful answers, you demonstrate your expertise and show that you genuinely care about helping people make informed decisions about life insurance.

Leveraging Twitter Features for Business Growth

Twitter offers various features that you can leverage to amplify your business growth and maximize your reach.

Using Hashtags Effectively

Hashtags are a powerful tool on Twitter to categorize and discover content. Research and use relevant hashtags that your target audience is likely to follow, ensuring that your tweets reach a wider audience. Additionally, create unique branded hashtags to promote campaigns or specific offerings.

Utilizing Twitter Ads for Greater Reach

To further enhance your reach, consider utilizing Twitter ads. These ads allow you to target specific demographics, interests, and location, ensuring that your life insurance business is visible to those who are most likely interested in your services. Experiment with various ad formats, such as promoted tweets or trends, to see what resonates best with your audience.

In conclusion, Twitter presents a wealth of opportunities for life insurance businesses to grow their reach and engage with their target audience effectively. By understanding the basics of Twitter, setting up a professional profile, developing a solid strategy, creating engaging content, and leveraging Twitter's features, you can position your business for success in the digital landscape.