How to Create a Sales Pipeline for Financial Services

Creating a sales pipeline for financial services can be a complex task, but it is essential for the success of any financial institution. It involves identifying potential clients, nurturing these leads, and finally converting them into customers. This process can be simplified and made more effective by creating a structured sales pipeline. In this guide, we will delve into the steps involved in creating a sales pipeline for financial services.

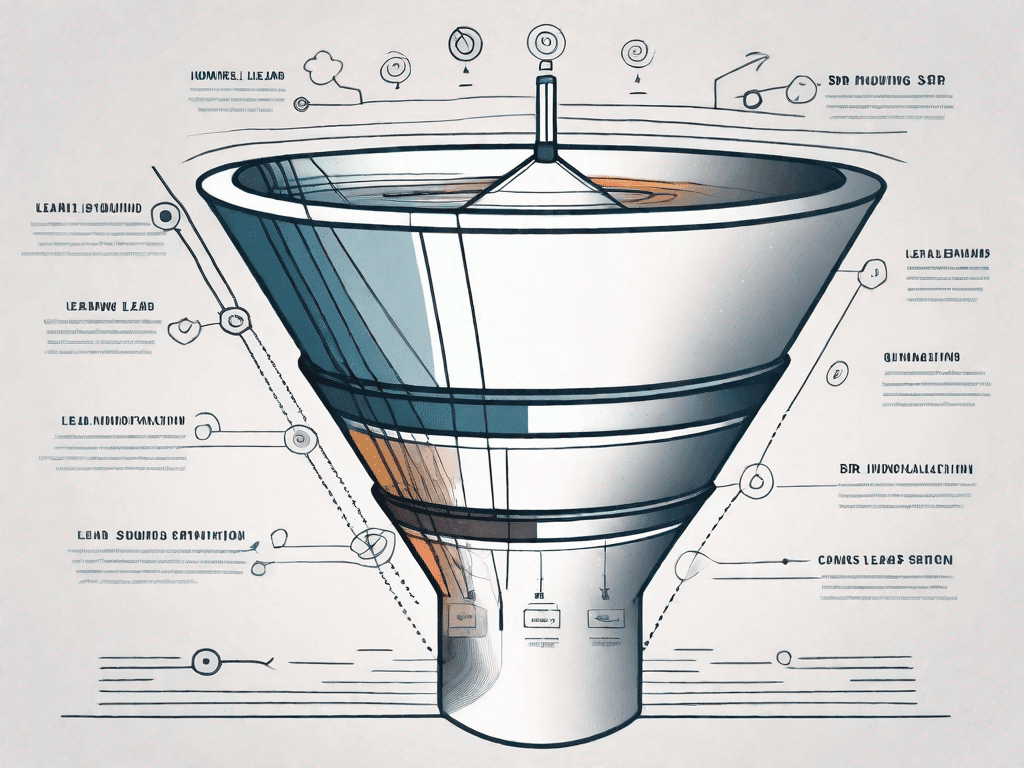

Understanding the Sales Pipeline

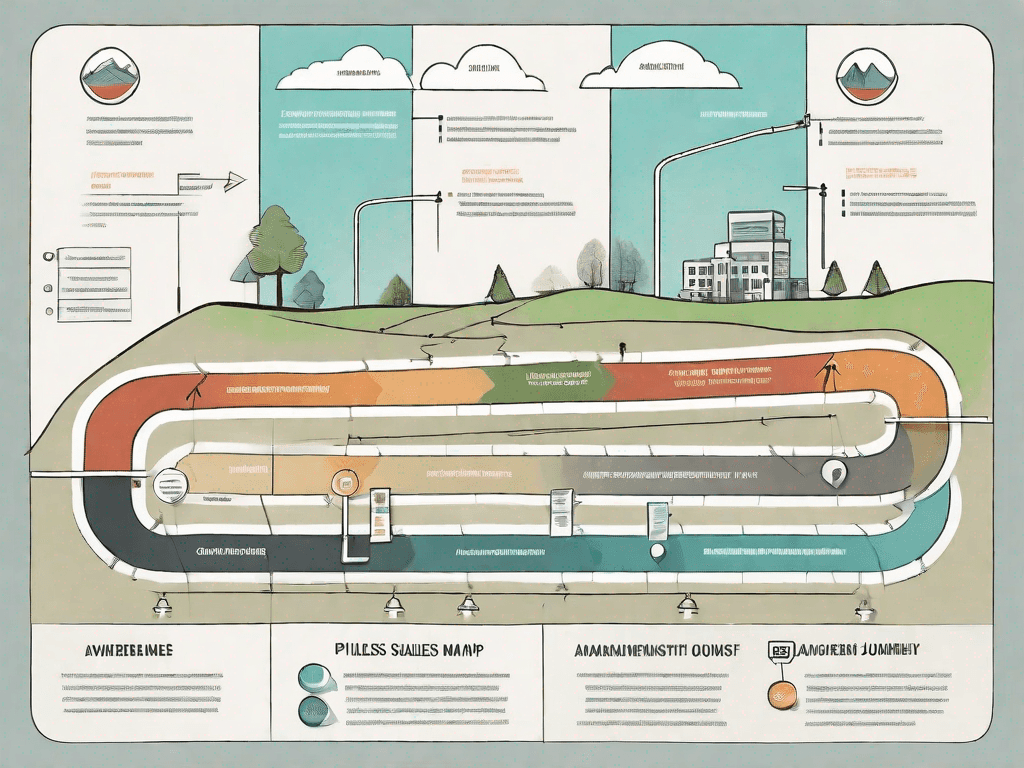

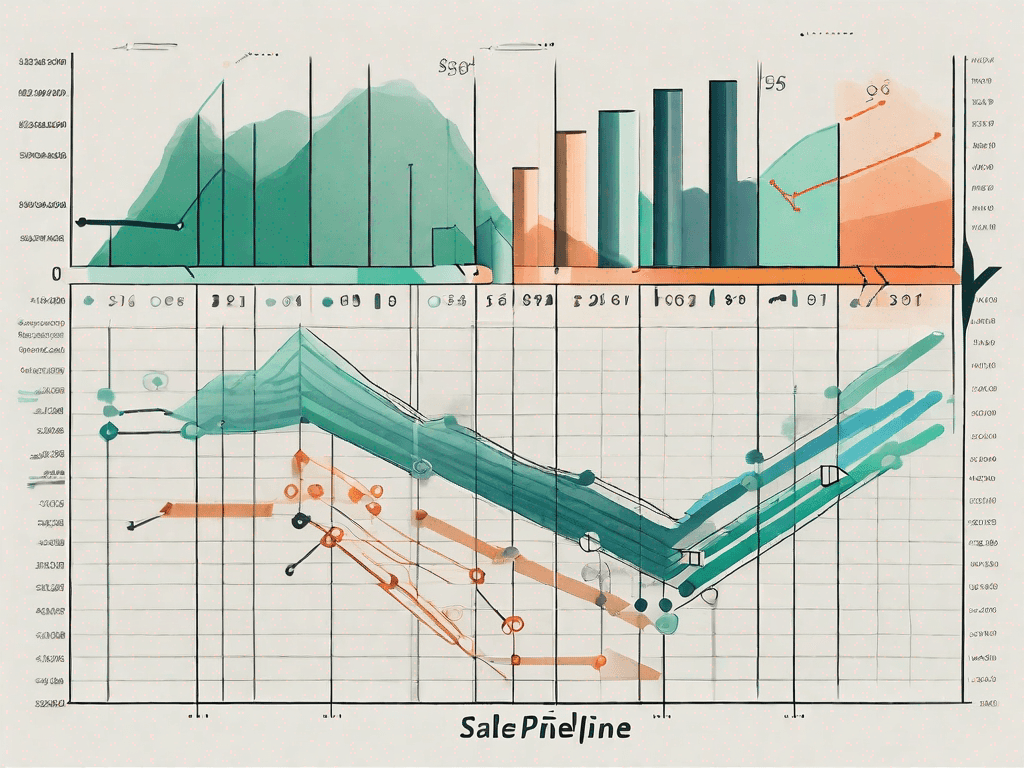

The sales pipeline is a visual representation of the sales process, from the initial contact with a potential client to the final sale. It helps sales teams to understand where potential clients are in the sales process and to identify any bottlenecks that may be slowing down sales. The sales pipeline is also a valuable tool for forecasting future sales and revenue.

Creating a sales pipeline involves several steps, including identifying potential clients, nurturing these leads, and finally converting them into customers. Each of these steps requires careful planning and execution to ensure that potential clients are effectively moved through the pipeline.

Identifying Potential Clients

The first step in creating a sales pipeline is identifying potential clients. This can be done through various methods, such as market research, networking events, and online marketing strategies. The goal is to create a list of potential clients who are likely to be interested in your financial services.

Once you have identified potential clients, it's important to qualify these leads to ensure that they are a good fit for your services. This involves assessing their financial needs and determining whether your services can meet these needs. Qualified leads are then moved to the next stage of the sales pipeline.

Nurturing Leads

Once potential clients have been identified and qualified, the next step is to nurture these leads. This involves building relationships with potential clients and providing them with valuable information about your services. This can be done through various methods, such as email marketing, content marketing, and social media marketing.

Nurturing leads is a crucial step in the sales pipeline, as it helps to build trust with potential clients and to position your financial institution as a trusted advisor. This can significantly increase the chances of converting these leads into customers.

Converting Leads into Customers

The final step in the sales pipeline is converting leads into customers. This involves persuading potential clients to purchase your financial services. This can be done through various methods, such as sales presentations, product demonstrations, and negotiation strategies.

Converting leads into customers is the ultimate goal of the sales pipeline. However, it's important to note that not all leads will convert into customers. Therefore, it's crucial to continuously monitor and adjust your sales pipeline to ensure that it is effectively moving potential clients through the sales process.

Monitoring and Adjusting Your Sales Pipeline

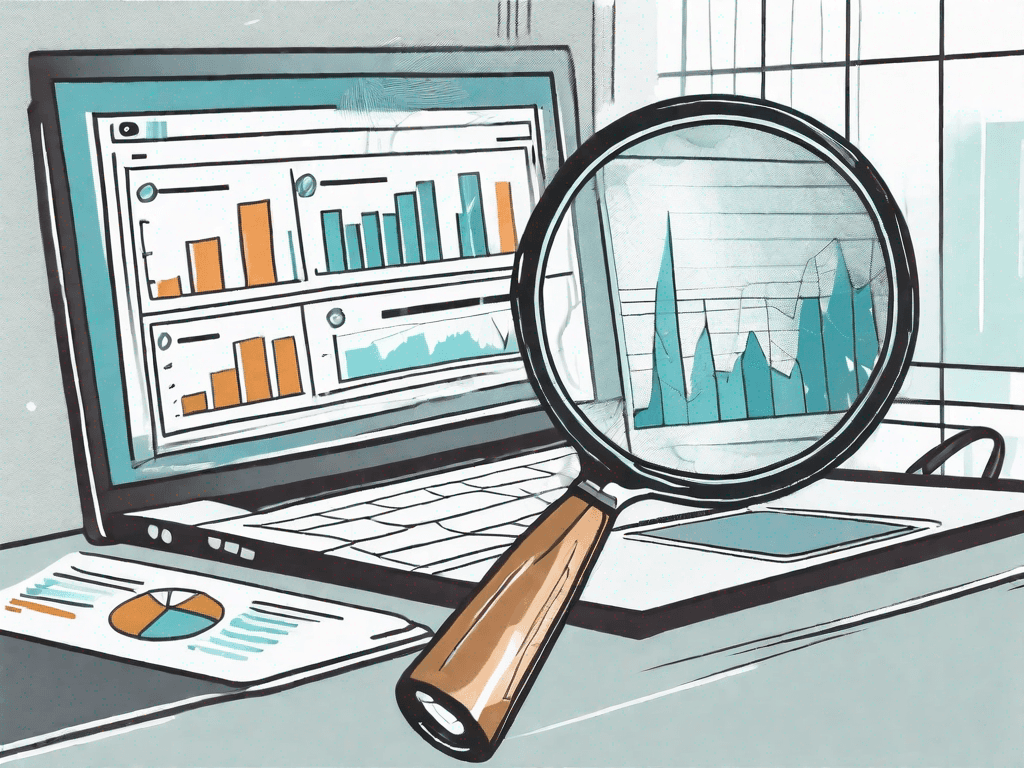

Once your sales pipeline is in place, it's important to continuously monitor and adjust it to ensure that it is effectively moving potential clients through the sales process. This involves tracking key metrics, such as the number of leads at each stage of the pipeline, the conversion rate, and the average time it takes to move a lead through the pipeline.

Monitoring your sales pipeline can help you to identify any bottlenecks that may be slowing down sales. For example, if you notice that a large number of leads are getting stuck at the nurturing stage, this may indicate that your nurturing strategies are not effective. In this case, you may need to adjust your strategies to better nurture leads and move them through the pipeline.

Using CRM Tools to Manage Your Sales Pipeline

Managing a sales pipeline can be a complex task, especially for larger financial institutions. Fortunately, there are various Customer Relationship Management (CRM) tools available that can simplify this process. These tools can help you to track leads, manage relationships with potential clients, and monitor key metrics related to your sales pipeline.

Using a CRM tool can significantly improve the efficiency of your sales pipeline and help you to better manage your sales process. However, it's important to choose a CRM tool that fits your needs and to properly train your sales team on how to use it.

Conclusion

Creating a sales pipeline for financial services can be a complex task, but it is essential for the success of any financial institution. By identifying potential clients, nurturing these leads, and finally converting them into customers, you can create a structured sales pipeline that effectively moves potential clients through the sales process.

Remember, the key to a successful sales pipeline is continuous monitoring and adjustment. By tracking key metrics and adjusting your strategies as needed, you can ensure that your sales pipeline is always optimized for success.