How to Get Funding for a Business?

Starting a business is an exciting venture, but it also comes with its fair share of challenges. One of the most significant hurdles that entrepreneurs face is securing funding to get their business off the ground. This article aims to guide you through the process of securing funding for your business, exploring various sources of funding, and providing tips on how to approach potential investors.

Understanding Different Types of Funding

Before you start seeking funding, it's crucial to understand the different types of funding available. Each type of funding has its own set of advantages and disadvantages, and the best choice for your business will depend on your specific circumstances and needs.

Typically, funding options can be divided into two main categories: debt and equity. Debt involves borrowing money that must be paid back with interest, while equity involves selling a portion of your business to an investor in return for capital.

Debt Financing

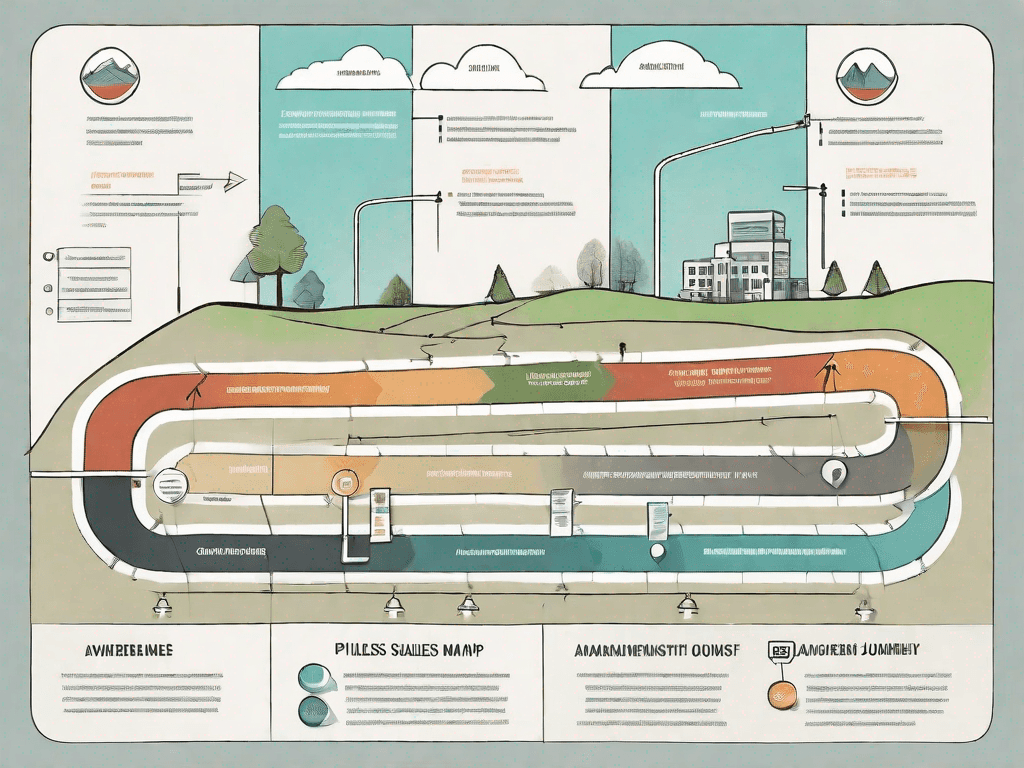

Debt financing involves taking on a loan that you will need to repay over time, with interest. This can be a good option for businesses that have a solid plan for generating revenue quickly, as it allows you to retain full control over your business. However, it also comes with the risk of debt if your business does not generate enough revenue to cover the loan repayments.

There are several types of debt financing, including bank loans, microloans, and credit cards. The best choice will depend on the amount of money you need, your credit score, and your business plan.

Equity Financing

Equity financing involves selling a portion of your business to an investor in return for capital. This can be a good option for businesses that need a large amount of capital and are willing to give up some control over their business. However, it also means that you will need to share your profits with your investors.

There are several types of equity financing, including venture capital, angel investors, and crowdfunding. The best choice will depend on the amount of money you need, the stage of your business, and your growth potential.

How to Approach Potential Investors

Once you have a clear understanding of the different types of funding and have decided on the best option for your business, the next step is to approach potential investors. This can be a challenging process, but with the right preparation and approach, you can increase your chances of securing the funding you need.

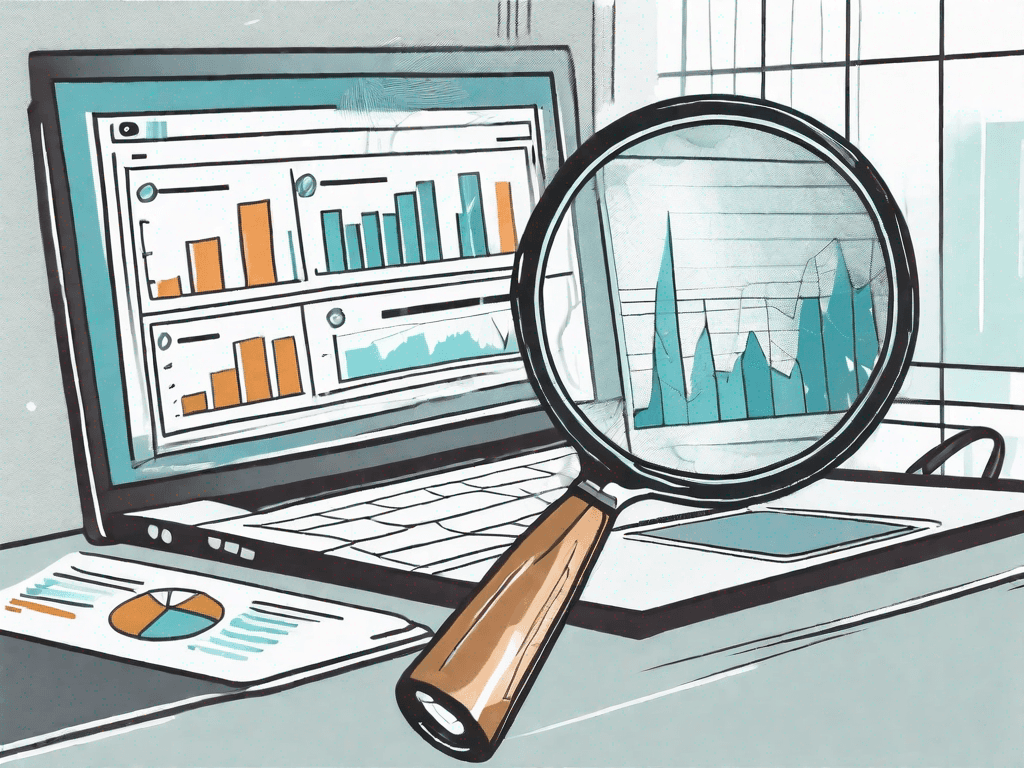

Firstly, you need to create a compelling business plan. This should include a clear explanation of your business idea, your target market, your marketing and sales strategy, and your financial projections. Your business plan is your opportunity to convince potential investors that your business is a worthwhile investment, so it's crucial to make it as compelling and detailed as possible.

Presenting Your Business Plan

When presenting your business plan to potential investors, it's important to be confident and passionate about your business idea. However, it's also important to be realistic and honest about the challenges your business may face. Investors want to see that you have a clear understanding of your business and its potential, but they also want to see that you are aware of the risks and have a plan to mitigate them.

It's also crucial to be prepared to answer any questions that potential investors may have. This means doing your research and being able to provide detailed information about your market, your competition, and your financial projections.

Negotiating Terms

Once you have presented your business plan and a potential investor has expressed interest, the next step is to negotiate the terms of the investment. This can be a complex process, and it's often a good idea to seek legal advice to ensure that you understand all the implications of the agreement.

During the negotiation process, it's important to be clear about what you are willing to give up in return for the investment. This could include a portion of your profits, a share of your business, or a say in business decisions. It's crucial to consider these factors carefully and to negotiate a deal that is fair and beneficial for both parties.

Conclusion

Securing funding for a business can be a challenging process, but with the right understanding of the different types of funding and a solid approach to potential investors, it's possible to secure the capital you need to get your business off the ground. Remember, the key to securing funding is to be prepared, be passionate about your business idea, and be willing to work hard to make your business a success.

Whether you choose debt or equity financing, remember that each type of funding comes with its own set of advantages and disadvantages. The best choice for your business will depend on your specific circumstances and needs. So, do your research, consider your options carefully, and choose the funding option that best suits your business and your goals.