How to Create a Sales Funnel for Financial Services

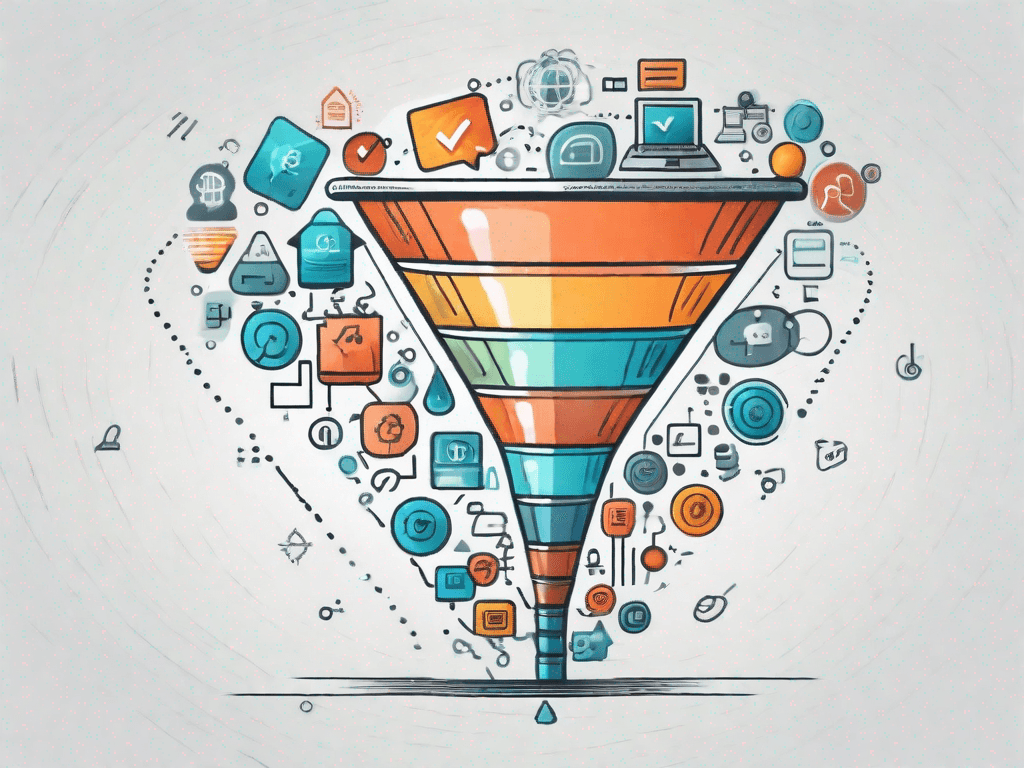

In the highly competitive financial services industry, it's essential to have a well-structured sales funnel. This is a strategic process that guides potential customers from the awareness stage to the decision stage, ultimately leading to a sale. A well-crafted sales funnel not only increases conversions but also helps in building long-term relationships with clients. In this guide, we will delve into the steps to create an effective sales funnel for financial services.

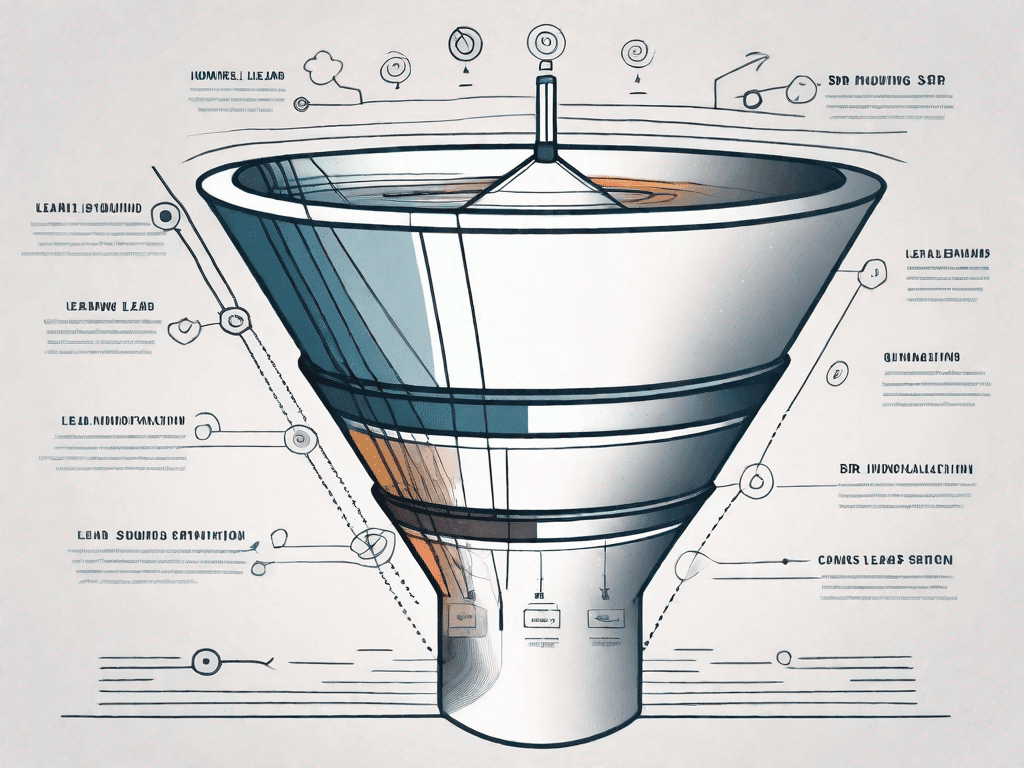

Understanding the Sales Funnel

A sales funnel, also known as a purchase funnel, is a model that illustrates the theoretical customer journey towards the purchase of a product or service. It's called a funnel because it starts broad at the awareness stage (top of the funnel) and narrows down towards the decision stage (bottom of the funnel).

In the context of financial services, the sales funnel could represent the journey of a potential client from the moment they learn about your financial services to the point where they decide to purchase a financial product or service from you.

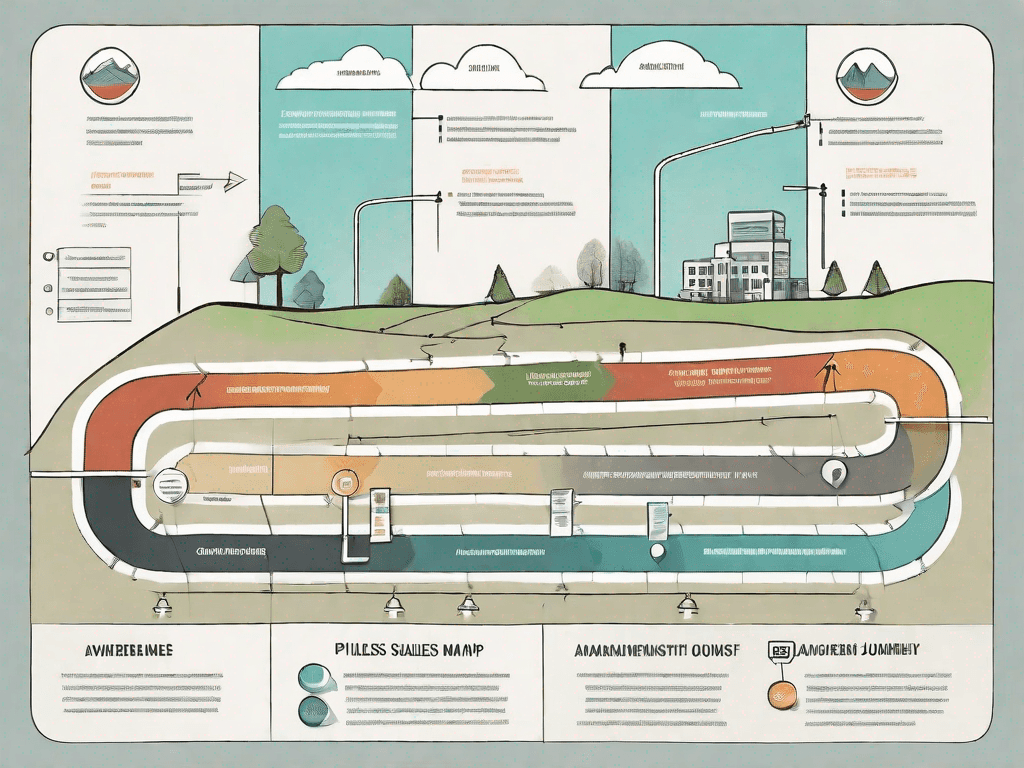

The Stages of a Sales Funnel

The sales funnel typically consists of four stages: Awareness, Interest, Decision, and Action. Each stage requires a different approach in terms of marketing and communication strategies.

The Awareness stage is where potential customers first learn about your financial services. This could be through online search, social media, or word of mouth.

In the Interest stage, potential customers are considering your services as a possible solution to their financial needs. They might compare your services with those of your competitors.

The Decision stage is when potential customers are ready to make a choice. They might request a proposal or more detailed information about your services.

The Action stage is the final step where potential customers become actual customers by purchasing a service.

Creating a Sales Funnel for Financial Services

Now that we understand what a sales funnel is and its stages, let's discuss how to create one for financial services. The process involves understanding your target audience, creating relevant content, leveraging digital marketing strategies, and analyzing the results for continuous improvement. "Creating funnels in the financial industry is always a challenge due to regulation, but if you can work through that, it's entirely worth it" says Pete Ridley from Car Finance Saver.

Understanding Your Target Audience

The first step in creating a sales funnel is to understand your target audience. This involves identifying their financial needs, preferences, and behaviors. You can gather this information through market research, surveys, and customer feedback.

Once you have a clear understanding of your target audience, you can tailor your marketing and communication strategies to attract and engage them effectively.

Creating Relevant Content

Content plays a crucial role in each stage of the sales funnel. In the awareness stage, you can use blog posts, articles, and social media posts to educate potential customers about your services. In the interest stage, you can provide more detailed content like eBooks, webinars, and case studies to help them understand how your services can meet their financial needs.

In the decision stage, you can offer free consultations, demos, or trials to convince potential customers to choose your services. Finally, in the action stage, you can use testimonials, reviews, and success stories to reinforce their decision and encourage them to make a purchase.

Leveraging Digital Marketing Strategies

Digital marketing strategies like SEO, email marketing, social media marketing, and pay-per-click advertising can help you attract, engage, and convert potential customers. SEO can increase your visibility in online search, while email marketing can help you nurture leads and stay top of mind. Social media marketing can help you reach a wider audience, and pay-per-click advertising can drive targeted traffic to your website.

It's important to use these strategies in a coordinated way to guide potential customers through the sales funnel. For example, you can use SEO to attract potential customers in the awareness stage, email marketing to nurture leads in the interest stage, and social media marketing to engage potential customers in the decision stage.

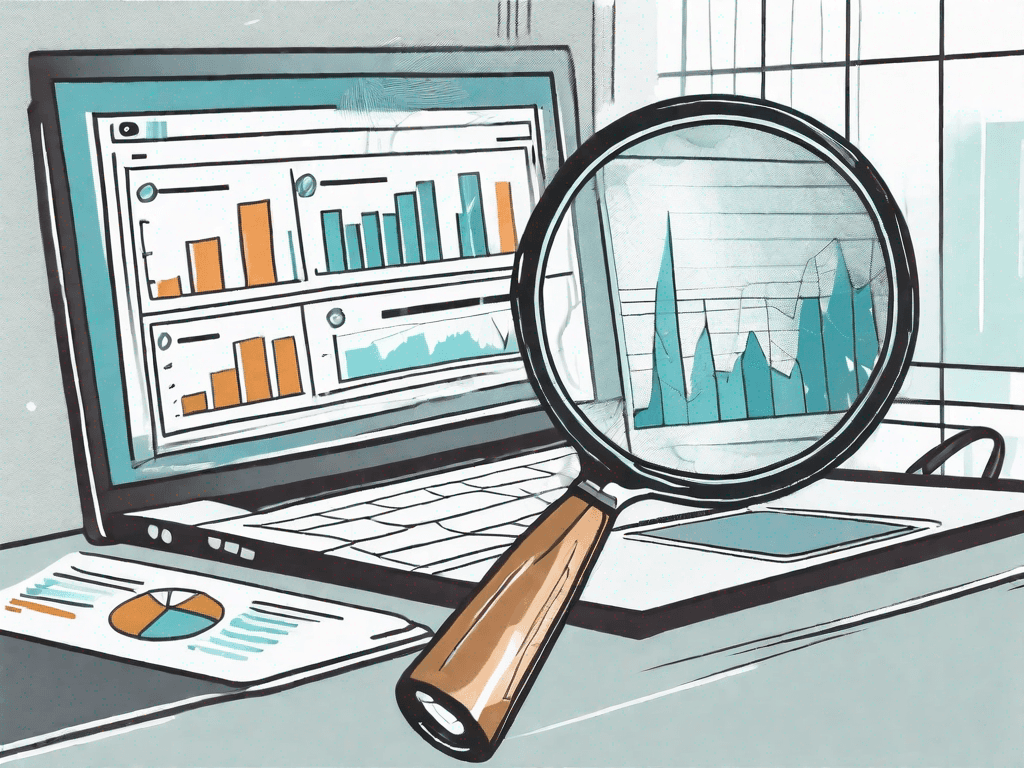

Analyzing the Results

Once you've implemented your sales funnel, it's important to analyze the results to identify areas for improvement. You can use analytics tools to track metrics like website traffic, conversion rates, and customer engagement. This data can provide insights into what's working and what's not, allowing you to refine your strategies and improve your sales funnel over time.

Conclusion

Creating a sales funnel for financial services involves understanding your target audience, creating relevant content, leveraging digital marketing strategies, and analyzing the results for continuous improvement. By guiding potential customers through the sales funnel, you can increase conversions, build long-term relationships, and drive growth in your financial services business.