Revenue vs Profit: What's the Difference?

In the world of finance, revenue and profit are two key terms that are often used interchangeably. However, understanding the difference between revenue and profit is crucial for individuals and businesses alike. In this article, we will delve into the definitions of revenue and profit, explore the disparities between the two, and provide practical examples to help illustrate their dissimilarities. So, let's get started

Defining Revenue and Profit

Before we can grasp the disparity between revenue and profit, it is essential to understand each term individually.

Revenue is a fundamental concept that refers to the total amount of money generated by a business through its primary operations. It represents the inflow of funds resulting from the sale of goods or services. Revenue is often called the top line of a company's financial statement as it is the initial entry prior to deducting expenses.

Now, let's dive deeper into the concept of revenue. Revenue can be categorized into two types: operating revenue and non-operating revenue. Operating revenue is the income generated from a company's core business activities. For example, a clothing retailer's operating revenue would come from the sales of clothes. On the other hand, non-operating revenue refers to income that is not directly related to the company's core operations. This could include rental income from properties owned by the company or gains from the sale of investments.

It is important to note that revenue does not necessarily equal profit. While revenue represents the total amount of money coming into a business, profit takes into account the expenses incurred to generate that revenue.

1°) What is Profit?

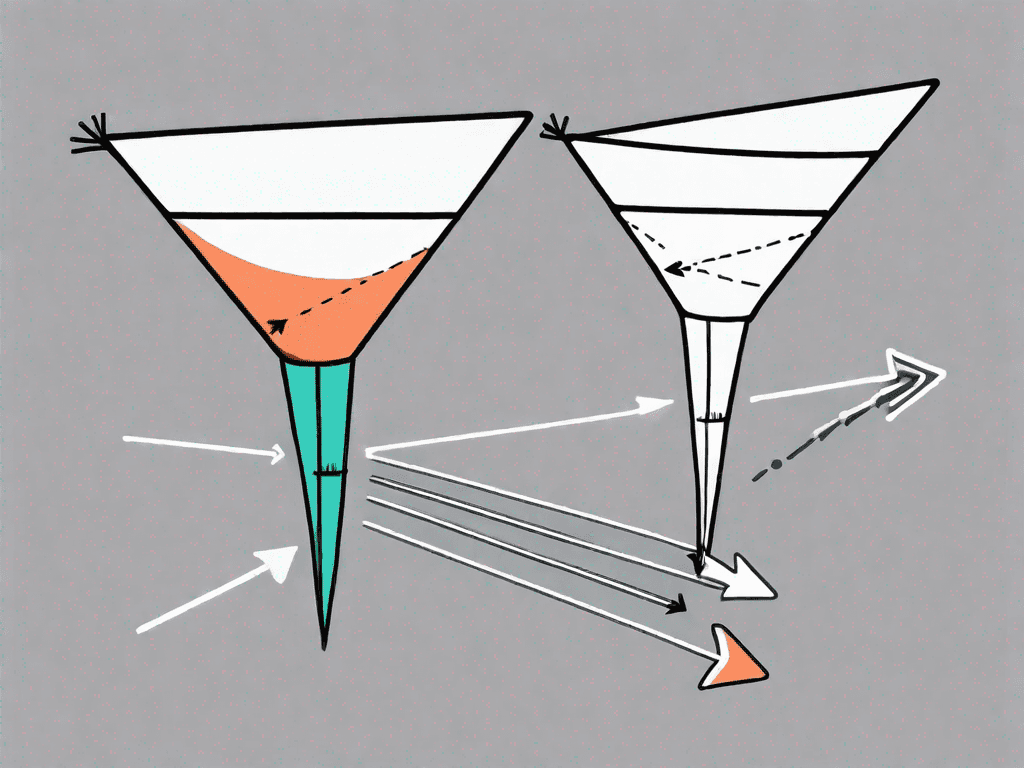

Profit, on the other hand, is the monetary gain achieved by a business after deducting all expenses, including operational costs, taxation, and interest. It is the bottom line of a company's financial statement and represents the surplus amount remaining after all expenses have been accounted for.

Let's explore the different components that contribute to profit. Firstly, we have the cost of goods sold (COGS), which includes the direct costs associated with producing or delivering the goods or services sold by a company. This can include raw materials, labor costs, and manufacturing expenses. By subtracting the COGS from the revenue, we arrive at the gross profit.

Next, we have operating expenses, which are the costs incurred in the day-to-day operations of a business. These can include salaries, rent, utilities, marketing expenses, and more. Subtracting the operating expenses from the gross profit gives us the operating profit, also known as earnings before interest and taxes (EBIT).

However, profit calculation doesn't end there. Taxes and interest expenses also need to be taken into account. Taxes are the amount a company pays to the government based on its taxable income, while interest expenses are the costs associated with borrowing money. After deducting taxes and interest expenses from the operating profit, we arrive at the net profit, which is the final figure that represents the true profitability of a business.

It's worth mentioning that profit can be further divided into net profit margin and gross profit margin. Net profit margin is calculated by dividing the net profit by the revenue and multiplying by 100, giving us a percentage that represents the profitability of the business. On the other hand, gross profit margin is calculated by dividing the gross profit by the revenue and multiplying by 100, indicating the percentage of revenue that remains after deducting the cost of goods sold.

Understanding the distinction between revenue and profit is crucial for businesses to evaluate their financial performance accurately. While revenue measures the total inflow of funds, profit provides a more comprehensive view by considering the expenses incurred to generate that revenue. By analyzing both revenue and profit, businesses can make informed decisions to optimize their operations and drive sustainable growth.

What's the Difference between Revenue and Profit?

Although revenue and profit are both financial terms, the biggest differentiating factor lies in their respective calculations.

Revenue is a straightforward calculation that indicates the total amount of money a business has generated, regardless of expenses. It includes all the income generated from sales of products or services, as well as any other sources of income such as royalties, licensing fees, or interest earned on investments. For example, a clothing store's revenue would include the money earned from selling clothes, as well as any additional income from selling accessories or gift cards.

Profit, however, reflects the financial gain or loss after accounting for expenses, providing a more accurate picture of a company's financial health. It is calculated by subtracting all the costs and expenses associated with running the business from the total revenue. These costs can include the cost of goods sold, operating expenses such as rent and utilities, employee salaries, and taxes. For instance, if a clothing store's revenue is $100,000 and its expenses amount to $80,000, then its profit would be $20,000.

Another key distinction is that revenue is a measure of a company's sales volume, indicating how much money is flowing into the business. It helps businesses understand the demand for their products or services and can be used to assess market trends and customer preferences. On the other hand, profit quantifies the efficiency of operations and the ability to generate financial gains. It shows how effectively a company is managing its expenses and generating income from its sales. A high profit margin indicates that a business is operating efficiently and generating a healthy return on investment.

Understanding the difference between revenue and profit is crucial for businesses to make informed financial decisions. While revenue provides a snapshot of a company's sales performance, profit gives a more comprehensive view of its financial viability. By analyzing both metrics, businesses can identify areas for improvement, optimize their operations, and ultimately strive for long-term financial success.

Examples of the Difference between Revenue and Profit

To better comprehend the disparities between revenue and profit, let's explore some practical examples in different business contexts.

2.1 - Example in a Startup Context

Imagine a budding startup that sells innovative gadgets online. In its first year, the company generates $1 million in revenue by selling its products. However, due to high production and marketing expenses, the company incurs a net loss of $200,000. In this case, while the startup has generated substantial revenue, it is not yet profitable.

2.2 - Example in a Consulting Context

Consider a consulting firm that offers its services to clients. In a given year, the firm generates $500,000 in revenue from its clients. After accounting for all expenses, including employee salaries and office rent, the company realizes a profit of $100,000. Here, the revenue indicates the total sales generated by the firm, while the profit represents the financial gain after expenses.

2.3 - Example in a Digital Marketing Agency Context

A digital marketing agency executes online advertising campaigns for its clients. During a specific period, the agency earns $2 million in revenue from campaign fees paid by clients. However, after factoring in expenses such as employee salaries, software subscriptions, and advertising costs, the agency records a profit of $500,000. In this instance, the revenue highlights the total amount earned from clients, while the profit demonstrates the agency's ability to generate a considerable surplus after expenses.

2.4 - Example with Analogies

To put revenue and profit into perspective, let's consider a bakery. The revenue would be equivalent to the total sales made by the bakery, while the profit would be the money remaining after subtracting all costs, including ingredients, labor, and overhead expenses. In this analogy, revenue tells us how much bread was sold, while profit reveals how much money the bakery made on those sales.

Similarly, if we compare a professional athlete to a sports team, the athlete's revenue would be their salary or endorsement deals, while the team's revenue encompasses ticket sales, sponsorship, and merchandise earnings. The profit, in this case, would be the surplus amount resulting from deducting all expenses incurred by the team.

In conclusion, while revenue and profit are often used interchangeably, they hold distinct meanings in the financial world. Revenue simply represents the total money generated by a business, while profit indicates the gain after accounting for all expenses. Understanding the difference between revenue and profit is crucial for individuals and businesses to effectively analyze financial performance and make informed decisions moving forward.