Average Revenue Per User (ARPU) vs Average Revenue Per Account (ARPA): What's the Difference?

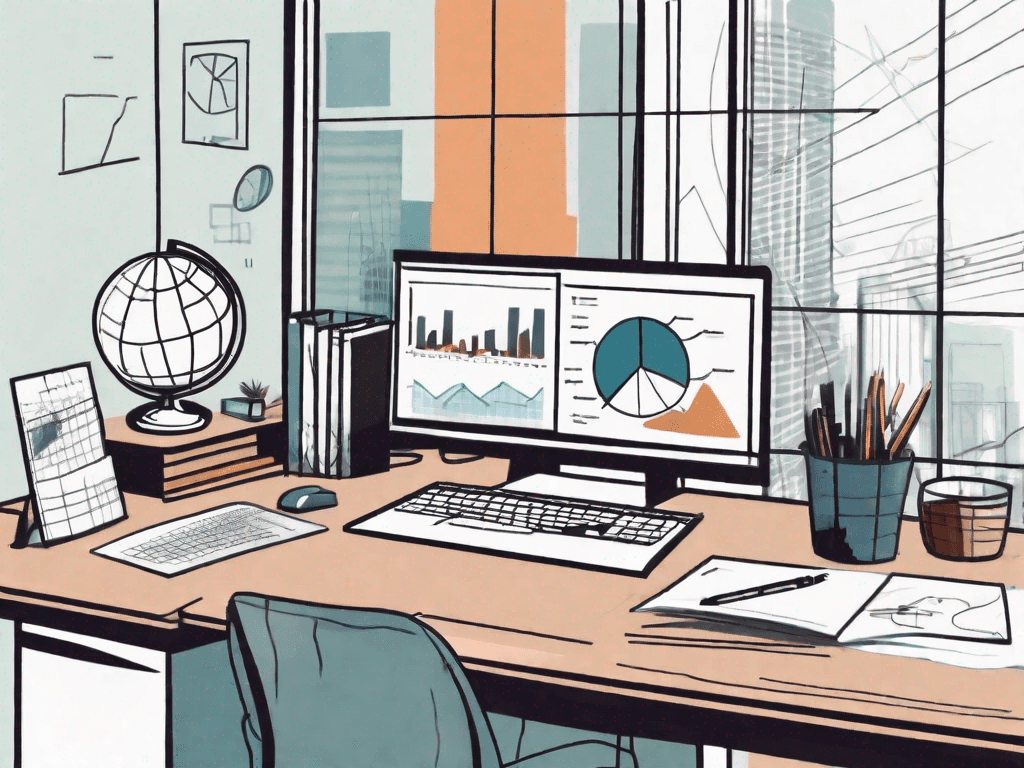

In the world of business, there are several key performance indicators (KPIs) that companies rely on to measure their financial success. Among these, two important metrics stand out: Average Revenue Per User (ARPU) and Average Revenue Per Account (ARPA). While they may seem similar at first glance, there are significant differences between the two that make them unique and valuable in their own right

Defining Average Revenue Per User (ARPU) and Average Revenue Per Account (ARPA)

1.1 - What is Average Revenue Per User (ARPU)?

ARPU is a metric that is commonly used in industries such as telecommunications, software as a service (SaaS), and media streaming. It represents the average amount of revenue generated per user over a specific time period. To calculate ARPU, you simply divide the total revenue by the number of users. This metric provides insights into how well a company is monetizing its user base.

Let's dive deeper into the concept of ARPU. Understanding this metric is crucial for businesses that rely on a large user base to generate revenue. By calculating ARPU, companies can gain valuable insights into their pricing strategies, user engagement, and overall revenue growth.

For example, let's consider a telecommunications company that offers various subscription plans. By calculating ARPU, the company can determine how much revenue it generates from each user on average. This information can help the company evaluate the profitability of its different subscription plans and make informed decisions about pricing adjustments or product offerings.

ARPU can also be used to track changes in user behavior over time. By comparing ARPU across different time periods, companies can identify trends and patterns in user spending habits. This information can be used to optimize marketing campaigns, improve customer retention strategies, and identify potential upselling or cross-selling opportunities.

In addition to its applications in the telecommunications industry, ARPU is also widely used in the software as a service (SaaS) and media streaming industries. SaaS companies often offer tiered pricing plans based on the features and functionality provided to users. By calculating ARPU, these companies can assess the revenue generated from each user segment and make data-driven decisions about product development and pricing strategies.

1.2 - What is Average Revenue Per Account (ARPA)?

ARPA, on the other hand, focuses on the average revenue generated per individual account. It is commonly used in industries such as banking, finance, and subscription-based services. To calculate ARPA, you divide the total revenue by the number of accounts. This metric helps companies understand the value they are extracting from each unique account.

Let's explore the concept of ARPA further. In industries where customers have individual accounts, such as banking or finance, understanding the average revenue per account is crucial for evaluating the profitability of each customer relationship. By calculating ARPA, companies can assess the revenue generated from each account and identify opportunities for growth and optimization.

For example, in the banking industry, ARPA can provide insights into the average revenue generated from each customer's account. This metric can help banks evaluate the effectiveness of their product offerings, identify high-value customers, and develop tailored strategies to increase customer satisfaction and loyalty.

ARPA is also relevant in subscription-based services, where customers have individual accounts tied to their subscriptions. By calculating ARPA, companies can assess the revenue generated from each subscriber and evaluate the profitability of their subscription plans. This information can be used to optimize pricing strategies, identify opportunities for upselling or cross-selling, and improve customer retention.

Furthermore, ARPA can be used to track changes in customer behavior and preferences. By comparing ARPA across different time periods, companies can identify shifts in customer spending patterns, identify emerging trends, and adapt their strategies accordingly.

In conclusion, both ARPU and ARPA are important metrics for businesses operating in various industries. ARPU provides insights into the average revenue generated per user, while ARPA focuses on the average revenue generated per account. By calculating and analyzing these metrics, companies can make informed decisions about pricing strategies, product development, and customer relationship management.

What's the difference between Average Revenue Per User (ARPU) and Average Revenue Per Account (ARPA)?

While both ARPU and ARPA measure revenue per customer, the key distinction lies in the unit of analysis. ARPU looks at revenue per user, whereas ARPA looks at revenue per account. This distinction becomes particularly relevant in scenarios where a single user can have multiple accounts or vice versa.

For example, in the case of a telecommunications company, a user may have multiple phone lines or devices associated with a single account. In this scenario, ARPU would provide insights into the revenue generated from each user, regardless of the number of accounts they have. On the other hand, ARPA would focus on the revenue generated from each unique account, regardless of the number of users associated with it.

Examples of the Difference between Average Revenue Per User (ARPU) and Average Revenue Per Account (ARPA)

2.1 - Example in a Startup Context

Let's say there is a startup that offers a software product with different pricing tiers. Each user can have multiple accounts, depending on the number of projects they manage. In this case, ARPU would provide insights into the average revenue generated per user, regardless of the number of accounts they have. On the other hand, ARPA would focus on the average revenue generated per account, regardless of the number of users associated with each account.

2.2 - Example in a Consulting Context

In the consulting industry, a firm may have multiple clients that they provide services to. Each client represents an account, and within each account, there may be multiple individuals involved in decision-making. ARPA would help the consulting firm understand the average revenue generated per account, regardless of the number of individuals within each account. ARPU, on the other hand, would provide insights into the average revenue generated per individual, regardless of the number of accounts they are associated with.

2.3 - Example in a Digital Marketing Agency Context

A digital marketing agency may work with multiple clients, each representing an account. Each client might have multiple campaigns running simultaneously. In this scenario, ARPA would provide insights into the average revenue generated per account, regardless of the number of campaigns within each account. ARPU would focus on the average revenue generated per user, regardless of the number of accounts they are associated with.

2.4 - Example with Analogies

To further illustrate the difference between ARPU and ARPA, let's consider two analogies. Imagine that you are running a cafe. ARPU would be akin to the average revenue per customer who visits your cafe, regardless of the number of times they visit. ARPA, on the other hand, would be similar to the average revenue per household, regardless of the number of individuals in each household.

In another example, let's say you have a digital streaming platform. ARPU would represent the average revenue per subscriber, regardless of the number of devices they use to access the platform. ARPA, on the other hand, would be the average revenue per device, regardless of the number of subscribers using each device.

Conclusion

In conclusion, Average Revenue Per User (ARPU) and Average Revenue Per Account (ARPA) are both important metrics in their respective industries. While ARPU focuses on revenue per user and gives valuable insights into user monetization, ARPA provides insights into revenue per account and helps companies understand the value they extract from each unique account. By understanding the differences and leveraging both metrics appropriately, companies can gain a comprehensive understanding of their financial performance and make data-driven decisions to drive growth and profitability.