How to Use A CRM for Life Insurance Agents

In today's digital age, the role of a life insurance agent has become more challenging than ever. With a plethora of leads and clients to manage, keeping track of important information and staying organized can be a daunting task. This is where a CRM (Customer Relationship Management) system comes to the rescue. A CRM can be a game-changer for life insurance agents, providing them with valuable tools and features to streamline their workflow and enhance productivity. In this article, we will explore the various ways in which life insurance agents can leverage a CRM to their advantage

How to use CRM features for Life Insurance Agents

One of the key features of a CRM that can greatly benefit life insurance agents is the reminders functionality. With a CRM, agents can set up timely reminders for important tasks such as follow-ups, policy renewals, and client meetings. These reminders can be customized to suit individual preferences and help agents stay on top of their game.

1.

CRM Reminders

Let's delve into an example to better understand how CRM reminders can be utilized effectively. Imagine you have a client whose policy is about to expire in a month. By setting a reminder in your CRM, you can ensure that you reach out to the client well in advance and guide them through the renewal process. This not only demonstrates your proactive approach but also strengthens your relationship with the client.

Additionally, CRM reminders can also be used to schedule follow-up calls or meetings with potential clients. For instance, if you meet someone at a networking event who expresses interest in life insurance, you can set a reminder to call them the next day to discuss their needs further. This level of organization and promptness can significantly increase your chances of converting leads into clients.

Moreover, CRM reminders can be utilized to keep track of important administrative tasks. From submitting paperwork to updating client records, a CRM can help you stay on top of these essential but often time-consuming activities. By setting reminders for these tasks, you can ensure that nothing falls through the cracks and that you maintain a high level of professionalism in your day-to-day operations.

Another valuable feature of a CRM is the email inbox integration. Life insurance agents receive a significant amount of emails every day, ranging from client inquiries to policy-related updates. With a CRM, agents can centralize all their email communications in one place, making it easier to manage and respond promptly.

1.

CRM Email Inbox

Let's consider an example to illustrate the benefits of CRM email inbox integration. Suppose you receive an email from a potential client who is interested in purchasing life insurance. With a CRM in place, you can quickly access the client's details, previous interactions, and policy recommendations all within the email interface. This allows you to provide personalized and targeted responses, enhancing the overall customer experience.

In addition to managing client inquiries, CRM email inbox integration can also streamline communication with insurance carriers. For instance, if you need to request a quote or submit an application, you can do so directly from your CRM's email interface. This eliminates the need to switch between multiple platforms, saving you time and ensuring that all communication is logged and easily accessible.

Furthermore, CRM email inbox integration can help you stay organized by automatically categorizing and prioritizing incoming emails. By setting up filters and rules, you can ensure that important emails are flagged and brought to your attention, while less urgent ones are sorted into appropriate folders. This level of automation can significantly improve your efficiency and ensure that you never miss an important message.

Furthermore, a CRM can also integrate with social media platforms, opening up avenues for life insurance agents to connect with potential leads and nurture existing client relationships. By leveraging social media integrations, agents can gain valuable insights into client preferences, engage in meaningful conversations, and strengthen their online presence.

1.

CRM Social Media Integrations

Let's explore an example of how CRM social media integrations can be effectively utilized. Imagine you come across a potential lead on a social media platform who has expressed interest in life insurance. With a CRM that integrates with social media, you can seamlessly import the lead's information, track their interactions, and initiate personalized conversations. This not only saves time but also allows you to build a rapport with the lead and eventually convert them into a valuable client.

In addition to lead generation, CRM social media integrations can also help you stay updated on industry trends and news. By following relevant hashtags and influencers, you can gather valuable insights that can inform your sales and marketing strategies. Moreover, by actively engaging with your audience on social media, you can establish yourself as a trusted expert in the field, attracting more potential clients and referrals.

Furthermore, CRM social media integrations can facilitate targeted advertising campaigns. By syncing your CRM with social media platforms, you can create custom audiences based on specific criteria such as age, location, and interests. This allows you to deliver highly relevant and personalized ads to potential clients, increasing the chances of conversion and maximizing your return on investment.

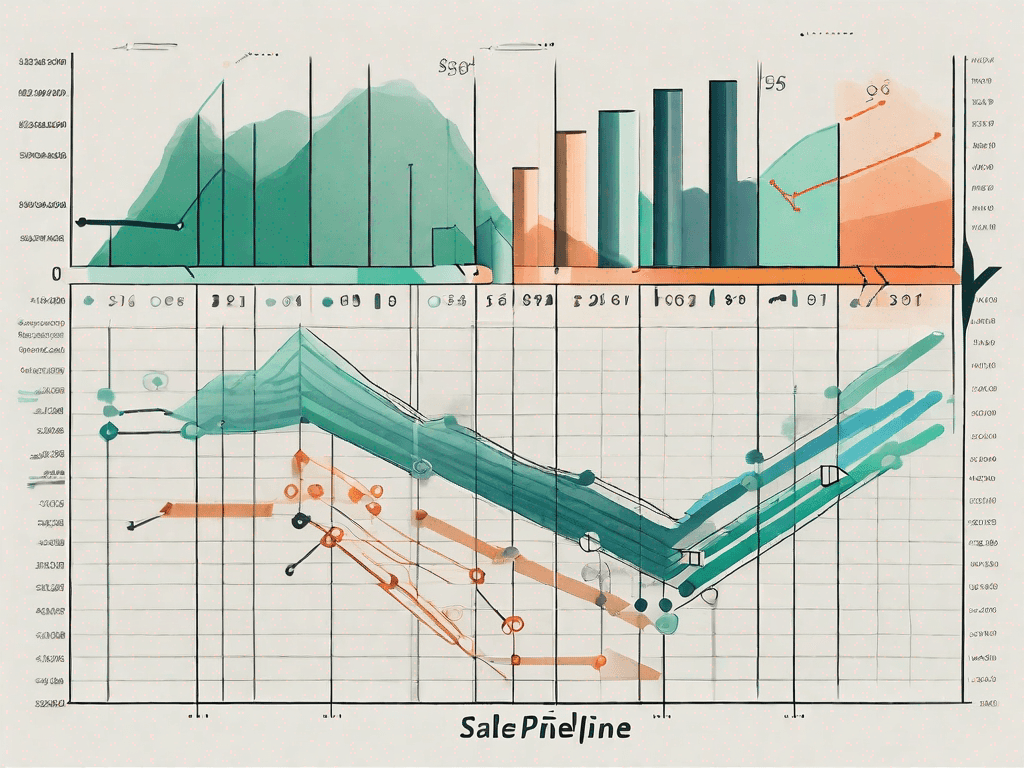

Last but not least, a CRM offers life insurance agents a comprehensive sales pipeline view. This feature enables agents to track and manage their sales process efficiently, from initial contact with a lead to closing the deal. By visualizing their sales pipeline, agents can identify bottlenecks, prioritize their efforts, and maximize their chances of success.

1.

CRM Sales Pipeline

Let's dive into an example to illustrate the power of a CRM sales pipeline. Imagine you have a list of warm prospects who have shown interest in life insurance policies. With a CRM, you can categorize these prospects, track their progress through the sales pipeline, and prioritize follow-ups based on their stage. This systematic approach allows you to efficiently nurture leads and increase your chances of converting them into paying clients.

Moreover, a CRM sales pipeline can provide valuable insights into your sales performance and help you identify areas for improvement. By analyzing the conversion rates at each stage of the pipeline, you can pinpoint potential bottlenecks or weaknesses in your sales process. This allows you to make data-driven decisions and implement strategies to optimize your sales performance.

-

Example with Closed Deals

Now, let's consider an example where a client has successfully purchased a life insurance policy. With a CRM, you can mark the deal as closed and set up post-sales touchpoints to ensure client satisfaction. This attention to detail not only strengthens your relationship with the client but also opens doors for future cross-selling and upselling opportunities.

For instance, you can set up automated emails or phone calls to check in with the client and address any questions or concerns they may have. This level of personalized follow-up demonstrates your commitment to their satisfaction and can lead to additional sales or referrals. Furthermore, by keeping track of closed deals in your CRM, you can easily identify opportunities for upselling or cross-selling based on the client's specific needs and preferences.

Examples of CRM use for Freelancers

CRM systems are not limited to only life insurance agents. Freelancers, who operate in a dynamic and fast-paced environment, can also benefit immensely from adopting a CRM. Let's explore some examples of how freelancers can make the most of a CRM system.

1.

Example with Cold Leads

For freelancers, attracting new clients is crucial for sustaining their business. By utilizing a CRM, freelancers can efficiently manage their cold leads. They can categorize leads based on their industry, interests, or project requirements, and customize their outreach strategies accordingly. This targeted approach increases the likelihood of converting cold leads into paying clients.2.

Example with Warm Prospects

Once freelancers have nurtured a relationship with potential clients and moved them from the cold lead stage to warm prospects, a CRM can further enhance the process. Freelancers can track their interactions, take notes on client preferences, and set up reminders for timely follow-ups. This level of organization and personalization sets freelancers apart and fosters long-term client loyalty.3.

Example with Closed Deals

When a freelancer successfully completes a project and secures payment, a CRM comes into play once again. Freelancers can keep a record of closed deals, track invoice history, and send follow-up messages to ensure client satisfaction. Building a strong reputation and fostering positive client relationships is essential for freelancers to sustain and grow their business.

In conclusion, a CRM can be a powerful tool for life insurance agents and freelancers alike. By leveraging CRM features such as reminders, email inbox integration, social media integrations, and sales pipeline management, professionals can streamline their workflow, enhance client relationships, and boost their overall productivity. The key lies in selecting a CRM system that aligns with specific needs and adopting it as an integral part of day-to-day operations. With the right CRM on their side, life insurance agents and freelancers can unlock their full potential and thrive in today's competitive landscape.