How To Create a Marketing Plan for Financial Firms?

Creating a marketing plan for financial firms is an intricate process that requires a deep understanding of the financial industry, the firm's specific goals, and the target audience. This guide will walk you through the necessary steps to create an effective marketing plan that will help your financial firm thrive in a competitive market.

Understanding the Financial Market

The first step in creating a marketing plan is understanding the financial market. This includes knowing the current trends, the major players, and the overall economic climate. This knowledge will help you identify opportunities and threats that could impact your marketing strategy.

Researching the financial market can be done through various methods such as reading industry reports, attending financial conferences, and conducting online research. The more information you have, the better equipped you will be to create a marketing plan that is tailored to your firm's needs.

Current Trends

Staying abreast of current trends in the financial industry is crucial. This could include trends in investment strategies, regulatory changes, or technological advancements. Understanding these trends will allow you to position your firm in a way that aligns with the direction the industry is heading.

For example, if there is a growing trend towards sustainable investing, your firm could consider offering green investment options. This would not only meet the demands of your target audience but also set your firm apart from competitors.

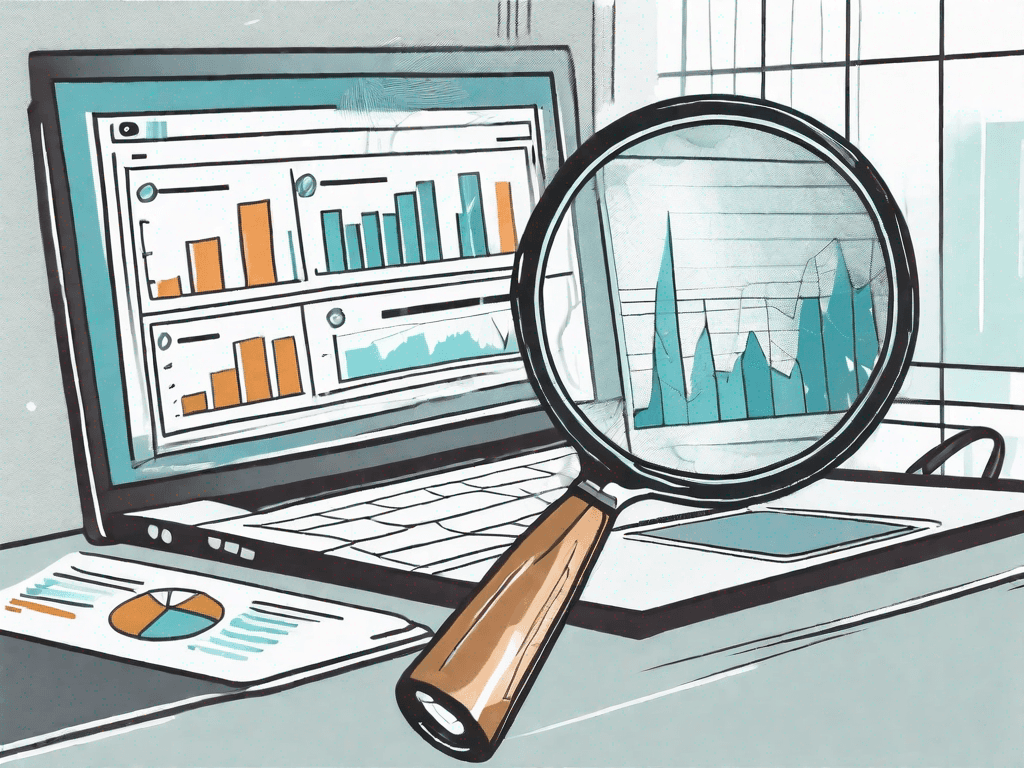

Major Players

Identifying the major players in the financial industry will help you understand who your competitors are and what they are offering. This information will allow you to differentiate your firm and create a unique value proposition.

Competitor analysis can be done by examining their marketing strategies, product offerings, and customer reviews. This will give you insights into what works and what doesn't, helping you avoid making the same mistakes and capitalizing on their successful strategies.

Defining Your Target Audience

Once you have a thorough understanding of the financial market, the next step is to define your target audience. This involves identifying who your potential clients are, what their financial needs are, and how your firm can meet those needs.

Defining your target audience can be done through market segmentation. This involves dividing the market into distinct groups based on characteristics such as age, income level, and financial goals. Once you have identified your target segments, you can tailor your marketing strategies to meet their specific needs.

Demographic Segmentation

Demographic segmentation involves dividing the market based on demographic factors such as age, gender, income, and occupation. For example, your firm might target high-income individuals who are looking for investment opportunities. Alternatively, you might target young professionals who are just starting to build their wealth.

Understanding the demographic characteristics of your target audience will help you create marketing messages that resonate with them. For example, if you are targeting young professionals, you might emphasize the importance of starting to invest early. On the other hand, if you are targeting high-income individuals, you might highlight your firm's expertise in managing large portfolios.

Behavioral Segmentation

Behavioral segmentation involves dividing the market based on consumer behavior. This includes factors such as purchasing habits, brand loyalty, and spending patterns. By understanding how your target audience behaves, you can tailor your marketing strategies to align with their behavior.

For example, if your target audience tends to do extensive research before making financial decisions, you might focus on providing detailed information and resources on your website. Alternatively, if your target audience values convenience, you might emphasize your firm's online services and easy-to-use platform.

Setting Marketing Goals

After defining your target audience, the next step is to set marketing goals. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). They should also align with your firm's overall business objectives.

For example, your marketing goals might include increasing brand awareness, attracting new clients, retaining existing clients, or increasing market share. Once you have defined your marketing goals, you can develop strategies to achieve them.

Brand Awareness

Increasing brand awareness involves making more people aware of your financial firm and what it offers. This can be done through various marketing strategies such as social media marketing, content marketing, and public relations.

For example, you might create a series of informative blog posts on financial topics and share them on social media. This not only provides value to your audience but also positions your firm as an expert in the field.

Client Acquisition and Retention

Attracting new clients and retaining existing ones is crucial for the growth of your financial firm. This can be achieved through strategies such as offering competitive products, providing excellent customer service, and implementing a referral program.

For example, you might offer a bonus for clients who refer new clients to your firm. This not only incentivizes your existing clients to promote your firm but also helps you acquire new clients through word-of-mouth marketing.

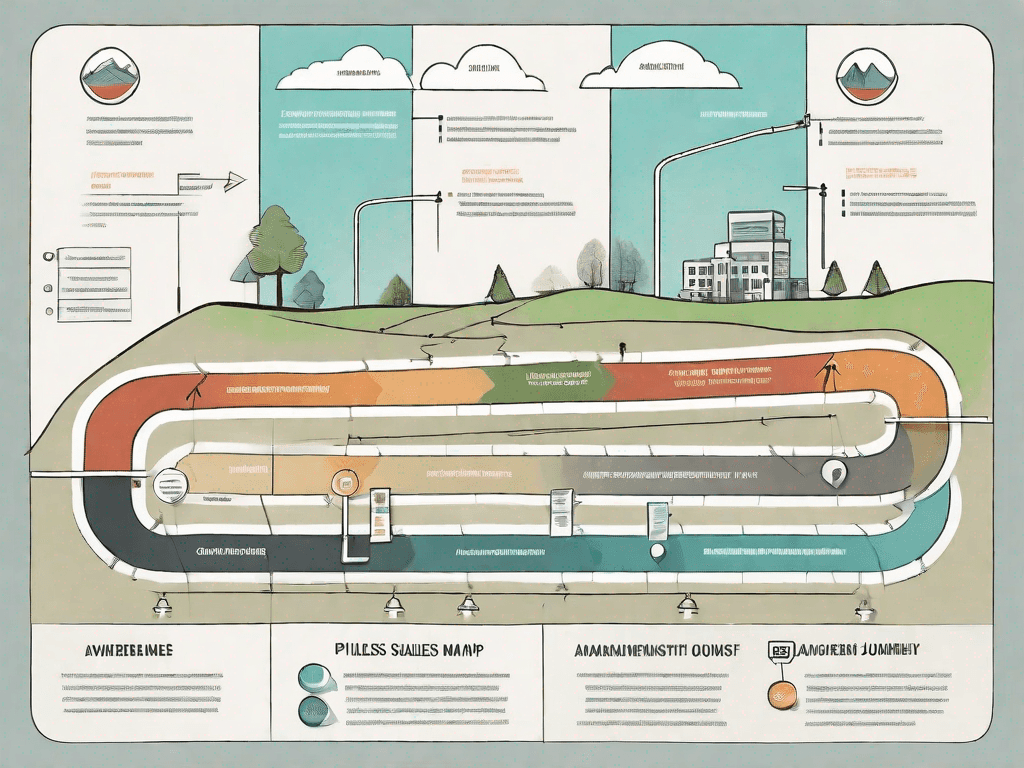

Developing a Marketing Strategy

The final step in creating a marketing plan is developing a marketing strategy. This involves deciding on the marketing mix (product, price, place, and promotion) that will help you achieve your marketing goals.

Your marketing strategy should be based on your understanding of the financial market, your target audience, and your marketing goals. It should also be flexible enough to adapt to changes in the market or your firm's objectives.

Product Strategy

Your product strategy involves deciding on the financial products and services that you will offer. These should meet the needs of your target audience and differentiate your firm from competitors.

For example, if your target audience is high-income individuals, you might offer premium investment services. Alternatively, if your target audience is young professionals, you might offer affordable investment options with low minimum investment requirements.

Pricing Strategy

Your pricing strategy involves deciding on the pricing for your financial products and services. This should reflect the value that your firm provides and be competitive with other firms in the market.

For example, you might offer a tiered pricing structure where clients pay more for premium services. Alternatively, you might offer a flat fee for all services, providing transparency and simplicity for your clients.

Place Strategy

Your place strategy involves deciding on the channels through which you will distribute your financial products and services. This could include physical locations, online platforms, or a combination of both.

For example, you might offer your services through a network of physical branches for clients who prefer face-to-face interaction. Alternatively, you might offer online services for clients who value convenience and flexibility.

Promotion Strategy

Your promotion strategy involves deciding on the marketing tactics that you will use to promote your financial products and services. This could include advertising, public relations, content marketing, or social media marketing.

For example, you might run a series of online ads to increase brand awareness. Alternatively, you might host financial seminars or webinars to provide value to your audience and position your firm as an expert in the field.

In conclusion, creating a marketing plan for financial firms involves understanding the financial market, defining your target audience, setting marketing goals, and developing a marketing strategy. By following these steps, you can create a marketing plan that will help your financial firm thrive in a competitive market.