How to Grow a Life Insurance Business with Facebook

In today's digital age, social media has become an invaluable tool for businesses looking to grow and expand their reach. Facebook, in particular, offers a unique opportunity for life insurance businesses to connect with potential customers and build a strong online presence. By understanding the power of Facebook for business growth and implementing an effective marketing strategy, you can elevate your life insurance business to new heights

Understanding the Power of Facebook for Business Growth

With over two billion active users, Facebook has cemented its position as the leading social media platform. Its vast user base presents a significant opportunity for businesses to connect with their target audience and drive growth. Moreover, Facebook's advanced targeting options allow you to reach potential customers based on their demographics, interests, and behaviors.

The Role of Social Media in Today's Business Landscape

In today's fast-paced business landscape, social media has emerged as a critical tool for businesses across industries. It provides an avenue for direct engagement with customers, helps build brand awareness, and facilitates lead generation. By leveraging the power of social media platforms like Facebook, life insurance businesses can effectively communicate with their audience and establish a strong online presence.

For instance, a life insurance company can create engaging content on Facebook that educates potential customers about the importance of life insurance and the various coverage options available. By sharing informative articles, videos, and infographics, the company can position itself as a trusted source of information in the industry. This not only helps in building brand credibility but also increases the likelihood of potential customers considering their services when the need arises.

Furthermore, Facebook's interactive features, such as polls, quizzes, and contests, can be utilized by insurance businesses to encourage audience participation and gather valuable insights. By asking thought-provoking questions or hosting competitions related to insurance, companies can not only increase engagement but also collect data about their target audience's preferences and needs. This data can then be used to tailor marketing messages and product offerings to better meet the expectations of potential customers.

Why Facebook is Essential for Insurance Businesses

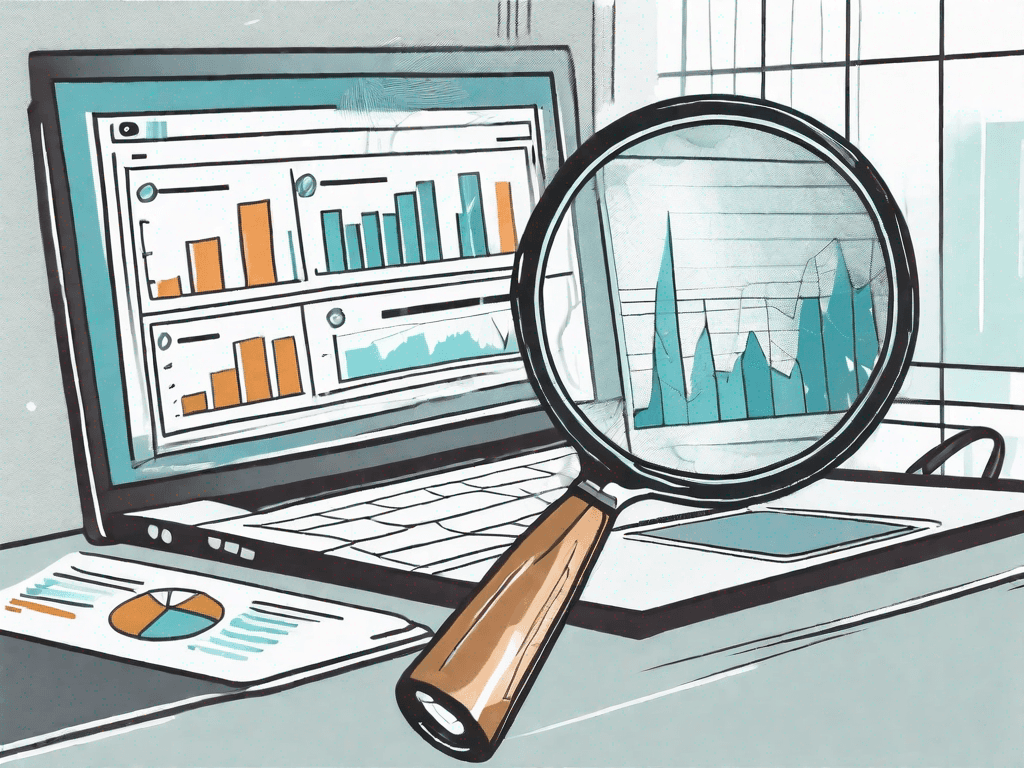

As an insurance business, you may wonder why Facebook is essential for your growth. The answer lies in the platform's ability to reach a wide audience, drive brand awareness, and nurture customer relationships. Furthermore, Facebook's advanced analytics and insights provide valuable data to help you refine your marketing strategy, identify target audience segments, and measure the effectiveness of your campaigns.

One of the key advantages of Facebook for insurance businesses is its ability to target specific demographics. With Facebook's robust advertising tools, you can create customized campaigns that are tailored to reach individuals who are more likely to be interested in your insurance products. For example, if you offer life insurance for young families, you can target your ads to parents within a specific age range, residing in certain locations, and with specific interests related to family and financial planning.

Additionally, Facebook's retargeting capabilities allow you to stay top-of-mind with potential customers who have shown interest in your products or visited your website. By placing a Facebook pixel on your website, you can track visitors and show them relevant ads on Facebook, reminding them of your offerings and encouraging them to take the next step in the customer journey.

Moreover, Facebook's analytics provide valuable insights into the performance of your marketing efforts. You can track metrics such as reach, engagement, and conversions to understand which campaigns are driving the most results. This data allows you to make data-driven decisions, optimize your marketing strategy, and allocate your budget effectively.

In conclusion, Facebook offers a powerful platform for insurance businesses to connect with their target audience, build brand awareness, and drive growth. By leveraging the platform's advanced targeting options, interactive features, and analytics, insurance companies can effectively communicate their value proposition, engage with potential customers, and measure the success of their marketing efforts. So, if you haven't already, it's time to harness the power of Facebook for your insurance business's growth.

Setting Up Your Life Insurance Business on Facebook

In order to tap into the potential Facebook offers, it is essential to set up a professional business page. This page will serve as the hub of your Facebook presence and provide a platform for showcasing your services and engaging with your audience.

Creating a Professional Business Page

To create a professional business page, navigate to Facebook's Business Manager or Pages Manager and follow the step-by-step instructions. Ensure that your page includes accurate and detailed information about your life insurance business, such as contact information, a compelling description, and relevant images.

Optimizing Your Business Profile for Maximum Reach

Optimizing your business profile involves using relevant keywords in your page's About section, selecting appropriate categories, and uploading high-quality images that reflect your brand. Additionally, make use of Facebook's call-to-action button feature to encourage visitors to take specific actions, such as contacting you for a quote or signing up for a newsletter.

Developing a Facebook Marketing Strategy for Your Insurance Business

With your professional business page set up, it's time to develop a comprehensive Facebook marketing strategy tailored to your life insurance business.

Identifying Your Target Audience on Facebook

Before diving into Facebook marketing, it's crucial to define your target audience. Who are they? What are their needs and pain points? By understanding your audience's demographics, interests, and behaviors, you can create content that resonates with them and drives engagement.

Crafting Engaging Content for Your Audience

Creating compelling content that speaks directly to your target audience is key to strengthening your Facebook presence. Share educational articles, industry news, tips for choosing the right life insurance policy, and stories that showcase how your services have helped customers in the past. Additionally, consider incorporating interactive elements such as polls, quizzes, and videos to boost engagement.

Leveraging Facebook Advertising for Your Insurance Business

While organic reach is valuable, Facebook advertising can significantly amplify your business's growth potential. With various ad formats and targeting options, you can tailor your ads to reach the right audience at the right time.

Understanding Facebook Ad Formats and When to Use Them

Facebook offers different ad formats, including image, video, carousel, slideshow, and lead generation ads. Choose the format that best conveys your message and aligns with your campaign goals. For example, video ads can be effective for storytelling, while lead generation ads can help you capture valuable customer information.

Setting Up Your First Facebook Ad Campaign

Setting up a Facebook ad campaign involves defining your objectives, audience targeting, setting a budget, and creating compelling ad copy and visuals. Regularly monitor and optimize your campaigns based on key metrics such as click-through rates, conversion rates, and cost per acquisition to ensure maximum effectiveness.

Engaging with Your Audience on Facebook

Engagement is the cornerstone of building a strong Facebook presence for your life insurance business. By actively interacting with your audience, you can foster trust, address concerns, and establish yourself as a knowledgeable industry expert.

Responding to Comments and Messages

Make it a priority to respond promptly to comments and messages on your Facebook page. Show genuine interest in your audience's questions, concerns, and feedback. Building a two-way communication channel through active engagement helps establish trust and build long-lasting relationships.

Using Facebook Live and Stories to Connect with Your Audience

Facebook Live and Stories provide excellent opportunities to engage with your audience in real-time. Consider hosting live Q&A sessions to address common life insurance queries, share behind-the-scenes glimpses of your business, or use stories to provide valuable tips and insights. These interactive features can help humanize your brand and strengthen the bond with your audience.

In conclusion, Facebook presents a vast array of opportunities for life insurance businesses to grow and expand their reach. By understanding the power of this social media platform, setting up a professional business page, developing a targeted marketing strategy, leveraging Facebook advertising, and engaging with your audience, you can position your life insurance business for long-term success in the digital world. Embrace the power of Facebook and watch your business thrive.