What is the Break-Even Point? (Explained With Examples)

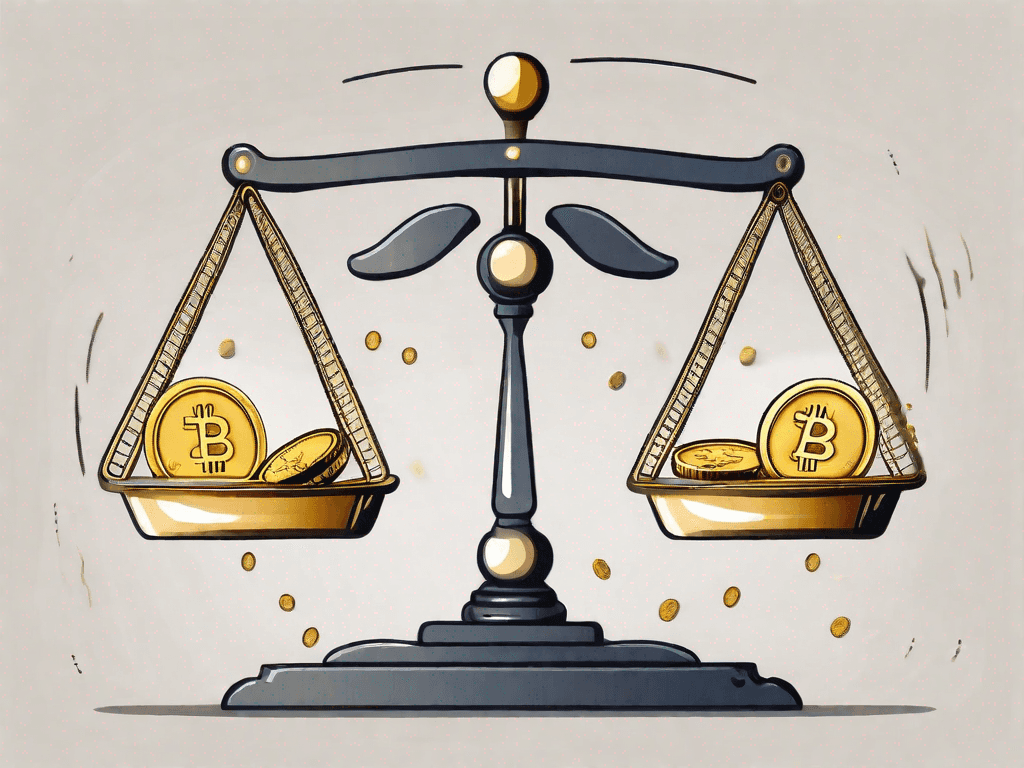

The break-even point is a crucial concept in business and finance. It refers to the point at which total revenues equal total costs, resulting in neither a profit nor a loss. Understanding the break-even point is vital for businesses as it helps them determine the minimum level of sales necessary to cover all their expenses

1°) What is the Break-Even Point?

The break-even point is a fundamental concept that businesses should be familiar with. It represents the point at which a company's total revenue equals its total costs. At this point, the business is neither making a profit nor incurring a loss.

Understanding the break-even point is crucial for businesses as it provides valuable insights into their financial performance. By analyzing this point, companies can determine the level of sales volume or revenue required to cover all fixed and variable costs, achieving a state of financial equilibrium.

1.1 - Definition of the Break-Even Point

The break-even point is defined as the level of sales volume or revenue at which a business covers all its fixed and variable costs. Fixed costs are expenses that do not change with the number of units produced or sold, such as rent and salaries. On the other hand, variable costs are costs that fluctuate based on the number of units produced or sold, such as raw materials and sales commissions.

By understanding the breakdown of costs, businesses can gain insights into their cost structure and make informed decisions regarding pricing, production levels, and overall financial health.

1.2 - Advantages of the Break-Even Point

The break-even point offers several advantages to businesses. Firstly, it serves as a useful financial tool for decision-making. By analyzing the break-even point, businesses can determine if a proposed investment or project is financially viable.

Additionally, understanding the break-even point allows businesses to assess their pricing strategy. If a company knows its break-even point, it can set prices that cover all costs and ensure profitability. This knowledge helps companies avoid underpricing their products or services, which can lead to financial losses.

Moreover, the break-even point provides businesses with a benchmark for evaluating their financial performance. By comparing actual sales and revenue to the break-even point, companies can assess their profitability and make necessary adjustments to improve their financial position.

1.3 - Disadvantages of the Break-Even Point

While the break-even point is a valuable metric, it does have its limitations. One disadvantage is that it assumes a linear relationship between costs and revenues. In reality, costs and revenues can be influenced by various factors, such as economies of scale, market conditions, and competition.

Moreover, the break-even point does not take into account other factors such as cash flow, profit margins, and return on investment. While it provides insights into covering costs, it does not consider the overall profitability and financial health of a business.

Therefore, it is essential for businesses to consider these factors in conjunction with the break-even point to make informed decisions. By analyzing the break-even point alongside other financial metrics, companies can gain a comprehensive understanding of their financial position and make strategic choices that drive long-term success.

2°) Examples of the Break-Even Point

The break-even point is a crucial concept in business that helps determine the minimum level of sales required to cover all costs and reach a point of financial equilibrium. It is calculated by dividing the total fixed costs by the contribution margin, which is the selling price per unit minus the variable costs per unit.

2.1 - Example in a Startup Context

Consider a startup that manufactures and sells handmade furniture. The fixed costs for the business include rent, utilities, and equipment, totaling $5,000 per month. The variable costs per unit, including materials and labor, come to $200. The selling price of each piece of furniture is $500.

Based on these figures, the break-even point can be calculated by dividing the total fixed costs by the contribution margin. In this example, the break-even point would be 33 units ($5,000 / ($500 - $200) = 33). This means the business needs to sell at least 33 pieces of furniture to cover all its costs and reach the break-even point.

Furthermore, reaching the break-even point is a significant milestone for startups as it indicates that they have achieved a level of sales that allows them to cover their expenses and move towards profitability.

2.2 - Example in a Consulting Context

In the consulting industry, a firm's fixed costs may include office rent, salaries, and professional liability insurance, totaling $10,000 per month. The variable costs per project, including travel expenses and subcontractor fees, amount to $5,000. The average consulting fee charged per project is $15,000.

Using these figures, the break-even point can be determined by dividing the total fixed costs by the contribution margin. In this scenario, the break-even point would be 2 projects ($10,000 / ($15,000 - $5,000) = 2). This means the consulting firm must secure at least 2 projects to cover all expenses and reach the break-even point.

Reaching the break-even point is crucial for consulting firms as it signifies that they have covered their costs and can start generating profits from additional projects. It also provides a measure of financial stability and sustainability for the firm.

2.3 - Example in a Digital Marketing Agency Context

For a digital marketing agency, fixed costs may include office space rental, software licenses, and salaries, totaling $15,000 per month. The variable costs, such as advertising expenses and freelancers' fees, come to an average of $7,000 per project. The agency charges clients an average of $20,000 for a marketing campaign.

Calculating the break-even point involves dividing the total fixed costs by the contribution margin. In this example, the break-even point would be approximately 2 projects ($15,000 / ($20,000 - $7,000) = 1.8). This means that the digital marketing agency needs to secure around 2 projects to cover all costs and reach the break-even point.

Reaching the break-even point is a significant milestone for digital marketing agencies as it signifies that they have covered their fixed and variable costs, allowing them to generate profits from additional projects. It also enables them to evaluate the profitability of their marketing campaigns and make informed decisions regarding pricing and resource allocation.

2.4 - Example with Analogies

To explain the concept of the break-even point using analogies, let's consider a lemonade stand. The fixed costs for the stand may include the lemonade mix and cups, which cost $10. The variable costs per cup sold include the cost of lemons, sugar, and water, totaling $0.50. The price for each cup of lemonade is $1.

By applying the break-even point formula (total fixed costs / contribution margin), we find that the break-even point for the lemonade stand is 20 cups ($10 / ($1 - $0.50) = 20). Therefore, the stand needs to sell at least 20 cups of lemonade to cover its expenses and reach the break-even point.

Understanding the break-even point is of utmost importance for businesses as it enables them to make informed decisions regarding pricing, investments, and financial stability. By calculating and analyzing the break-even point, businesses can strive towards profitability and long-term success.